Businesses of all shapes and sizes can operate in the global arena thanks to the many technological improvements over the years. Companies like Shopify, Amazon, and Wix played a vital role in helping UK small business owners to market their products and services across Europe and the world.

Dealing with foreign customers certainly opens a new set of challenges ranging from legal to language and dealing with foreign currencies. Traditional and high-street banks are no friends to e and are notorious for overcharging small businesses for their currency broker services.

Thankfully, the technological and digital revolution introduced a new and better way to handle international transactions. All of the top recommended brokers offer small business owners the opportunity to save money on foreign exchange transactions

This article will answer the question of whether your small business needs the service of a UK currency broker and offer some recommendations.

Does Your Business Need A UK Currency Broker?

Does your business need the service of a UK currency broker? The simple answer to a very simple question is it depends. Small businesses that target a domestic market and have zero international exposure have no need for a UK business currency broker.

But small businesses that target the world will find it advantageous to transact with a digital or online UK currency broker instead of their traditional bank. Whether it is moving euros, US dollars, yen, bahts, or nearly every currency in the world, standard banks are likely the worst option available.

In fact, banks appear to go out of their way to overcharge small business owners for currency transactions.

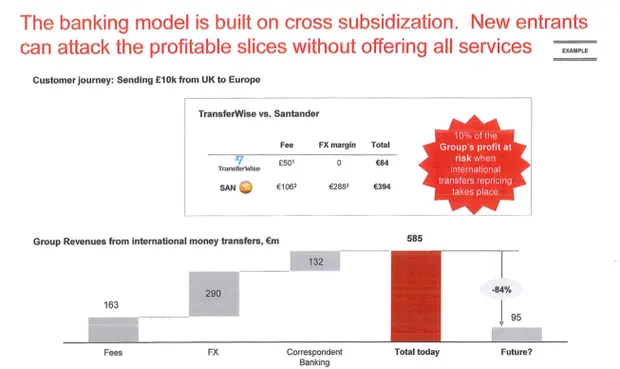

As noted by The Guardian in a 2017 report, a leaked memo from Santander highlights how the bank giant made €585m (£508.8 million) from foreign exchange transfers alone. The bank likely assumed it could get away with overcharging customers by as much as six times because they are unaware that alternative digital solutions existed.

The report highlighted how newcomer UK currency broker TransferWise (rebranded recently as Wise) was able to charge €64 to transfer £10,000 from the UK to Europe. By comparison, Santander charged €394 for an identical money transfer transaction.

Fast forward to 2021 and the savings gap may have narrowed but UK currency brokers continue to offer rates that banks can’t or don’t want to beat.

UK Currency Brokers Save Your Business Money

Anyone can obtain the most up-to-date exchange rate through Google or any currency exchange website and perform the calculations themselves. But this is not the amount a business owner will receive.

The end result of using traditional banks is a disappointed business owner who expected to convert 10,000 euros worth of sales to 8,700 pounds but instead, they received 8,500 pounds. The difference between expectation and reality is known in the financial universe as the spread — or as the banks call it: the cost of doing business.

UK banks are notorious for charging a spread as high as 2% to 3% on top of a fixed fee per transaction.

Instead, UK business currency brokers that specialize in foreign exchange transfers are able to operate much closer to the actual exchange rate. The industry norm within the UK currency broker industry is to charge a fee of less than 1% per transaction.

Many UK business currency brokers offer volume discounts on fees so it isn’t unusual for a business to exchange currencies at the actual exchange rate and pay a mere 0.15% fee.

What Other Value Can UK Currency Brokers Provide?

The top UK business currency brokers offer services that extend above and beyond converting sales in foreign currencies to pounds. One of the more notable features that can help small businesses minimize uncertainty is through forward exchange contracts.

A forward exchange, also known as a forward currency contract, lets a business owner or individual buy or sell a currency pair at a pre-agreed rate and on a set date. The agreement is binding and will be executed on the expiration date regardless of the actual exchange rate at that time.

Here is an example of why a business owner would choose to use this lesser-known feature that UK currency brokers offer.

Suppose a business owner knows they will collect €1 million from a transaction in six months. At current exchange rates, this equates to £870,000 and this money will be used to fund an expansion project.

If the exchange rate moves in the wrong direction during the six months period, the UK-based business owner could end up seeing just £820,000 and will need to scramble to pay £50,000 out of pocket to finance their plans.

Instead of sleepless nights and days spent watching live foreign exchange rates, the business owner can simply enter into a forward contract. On day one they will work with a UK currency broker to exchange 1 million euros for £870,000 (minus small fees) in six months from now.

The downside of forward contracts is the possibility that the currency exchange pairs move instead in a favorable direction. While this is a possibility, business owners prefer stability and certainty and aren’t interested in foreign exchange speculation and trading.

Top 4 UK Currency Brokers

Competition within the online UK money exchange industry is intense and a list of the top four currency brokers is merely a starting point.

-

Currencies Direct

Currencies Direct ranks top on the list of best UK currency brokers by default of its size. Currencies Direct is a true industry titan with more than £10 billion in annual turnover so it can benefit from the large economies of scale its competitors simply can’t.

-

TransferWise / Wise

Rebranded as Wise ahead of an initial public offering, Wise provides among the most transparent and open fee structures. Before initiating a transaction, the Wise user will know in advance how much money they will receive so if need be they can cancel the transaction before it starts.

-

Currency Index

While not a digital UK currency broker, Currency Index works with clients via email or telephone. The personal touch and helping hand are much appreciated by customers who for one reason or another prefer not to transact online.

-

Moneycorp

Moneycorp predates the modern internet as it has been helping clients exchange currencies since 1979. The company has certainly evolved over the years to address the digital era and it remains an industry leader with a truly global presence.