Various eCommerce Payment System and its Benefits

An electronic payment system (eCommerce Payment System) makes the acceptance of electronic payment for online transactions easier and flexible. UK Payment Gateway Providers are mainly targeting eCommerce stores and websites. Nowadays, people can start their business in the UK with a budget of 1000 pounds and they rely on customer’s payment on a regular basis, which could help them in maintaining the costs of operating.

If the payments made arrive late on a regular basis then there would be a financial crisis for all business owners. In addition, various negative effects of payment can make an impact on small businesses.

In order to avoid these problems, initially find a way to stash your money. Here we have outlined the simple and easiest ways to help your customers make payments effectively and faster by enrolling in online payment services. These payment services also avoid the stress out of the payment process for your small business.

Moreover, the online payment system has increasingly become popular nowadays in all sectors worldwide due to widespread usage of online shopping and banking.

Below mentioned are the Leading eCommerce Payment System and explained the process of how to make the payments easier, effective and budget-friendly

1. Credit Card Payment System

Comparatively considering the global payments, solution credit cards are considered to be the most popular process for the customers to make payments faster and easier. This process allows the merchants to reach out to an international market with credit cards by integrating a payment gateway interface into their business. The process has made a more secure online transaction with the help of a mobile card reader to access credit and debit cards. The mobile card reader is hardware that works by connecting a tablet or smartphone and accepting payments from the debit or credit cards and significantly changes mobile as the Point of Sale System (mPOS).

Although the credit card payment system makes the online transaction easy and faster the processing fees are high. Here are some of the information related to reducing credit card processing fees.

Usage of Credit card payment system

- For Online Purchasing

- Bill payment

- Can carry a balance

- Loan payment

Benefits

- Protects against fraud systems

- No foreign transactions fees

- Increased purchasing power

- Not linked to checking or savings account

- Opportunity to build credit

2. Blockchain Technology

Blockchain technology has created the backbone of a new type of internet technological innovation. It is devised for the digital currency. Initially, you should know what bitcoin, its usage is and where to buy bitcoins. In addition, anything built on to the Blockchain is very transparent by nature and everyone involved is accountable for his or her actions. In general, blockchain is the simplest and secure way of passing information where the transaction is done by creating blocks, which is verified by thousands of or millions of computers and stored for just creating a single record.

Hacking the single record means hacking the entire chain in a million instances, which is virtually impossible. Therefore, it is more secure for online transactions and the blockchain carries no online payment or transaction cost.

Usage of Blockchain Technology

Used in any industries like

- Agriculture

- Banking & health care

- Education

- Ecommerce

- Property, mining, retail

- Media and entertainment

Benefits

- Decentralization

- Immutability

- High security

- Transparency

3. ACH Payments

ACH stands for (Automated Clearing House) is a payment service that allows you to collect payments from your customers electronically for either single or recurring payments by directly debiting your customer’s checking or savings account. The working of ACH differs from the credit card payment system and other online transactions.

Usage of ACH

- Online bill payment

- Mortgage or loan repayment

- Direct deposit of payroll

- Person to person (P2P)

- Business to Customer (B2C)

- Business-to-Business (B2B)

Benefits

- The best alternative for your customers to credit cards and checks

- Lower cost payment than others

- Faster Payments cost-effective and cost-reducing

4. Payment Gateway

There are plenty of Payment gateway providers who provide excellent services in all the sectors and enhance a high level of security for each eCommerce Payment. The payment gateway can be provided by the bank to its customers but also by specialized financial service providers termed as payment service providers. In general, the payment gateway makes the transaction with the transfer information between a payment portal like website, mobile phone, or interactive voice response and an acquiring bank with ease of accessibility. When choosing the payment gateway various factors are to be taken into consideration to maintain a high level of security during transactions.

Usage of Payment gateway

- e-businesses

- Online retailers

- Bricks and mortar

Benefits

- Secure transactions(merchants 3D secure configurations)

- Expanded customer base

- Bundled with shopping cart

- Faster Transaction processing

- Added convenience

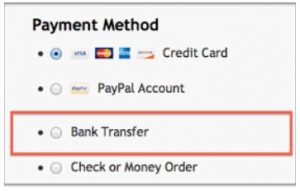

5. Bank Transfers

A bank transfer is a process of sending money from one bank to another in a fast, free, and safer transaction rather than withdrawal or paying cash in the bank. When you start a business, a bank account has to be created as an initial step to receive payments from the customer.

There are many ways involved in a bank transfer few among them are,

- Online bank transfer

- Telephone transfer

- In the branch bank transfer

Benefits

- Safe and secure transaction

- No payment reversals

- Transactions are not subject to chargeback

- Fully electronic

- Customer-friendly

The above mentioned are some of the most popular eCommerce Payment systems available worldwide with safe and secure transmittance online.

I hope, now you are familiar with the most commonly used online payment methods used. However, I would also like to bring the importance of WordPress a free open source content management system very useful in building an eCommerce Website, since there are plenty of premade themes suited to an online storefront. The top reason to use WordPress is a flexible platform that offers you complete control over your website. Moreover, once you start a business you should know how to register a business name and also to reach success in your business trademark is more important.

Since the eCommerce, transactions involve a series of steps that lead to a completed checkout WordPress helps a lot, in this case, to secure your eCommerce website while transactions.

Build your eCommerce Website with WordPress and enjoy safe and secure online transactions with the various online payment systems.